Longer-Term Refinancing Operations

Understanding LTROs (Long- Term Refinancing Operations)The financial industry is famous for its acronyms, from CPA to CDS. But, there has been one new acronym that has gained notoriety during the European sovereign debt crisis. LTRO is an acronym that stands for "long- term refinancing operations", which are used by the European Central Bank (ECB) to lend money at very low interest rates to euro zone banks. In this article, we'll take a look at how LTROs work, what it means for investors, and some alternatives that central banks can use to bolster liquidity in the financial system. How LTRO Work to Support Growth.

LTROs provide an injection of low interest rate funding to euro zone banks with sovereign debt as collateral on the loans. The loans are offered monthly and are typically repaid in three months, six months or one year. But the ECB also announced a three- year LTRO in December of 2. The LTROs are designed to have a two- fold impact: Greater Bank Liquidity - Low interest financing enables euro zone banks to increase lending activities and spur economic activity, as well as invest in higher yielding assets in order to generate a profit and improve a problematic balance sheet. Lower Sovereign Debt Yields - Euro zone countries can use their own sovereign debt as collateral, which increases demand for the bonds and lowers yields. For instance, Spain and Italy used this technique in 2.

LTRO operations themselves are conducted via an auction mechanism. The ECB determines the amount of liquidity that is to be auctioned and requests expressions of interest from banks. Interest rates are determined in either a fixed rate tender or a variable rate tender, where banks bid against each other to access the available liquidity. LTROs during the European Debt Crisis.

LTROs became popular during the European financial crisis that began in 2. Before the crisis hit, the ECB's longest tender offered was just three months. These LTROs amounted to just 4.

ECB's overall liquidity provided. These levels ultimately increased throughout the European debt crisis: March 2. The ECB offers its first supplementary LTRO with a six- month maturity is more than four times oversubscribed with bids from 1.

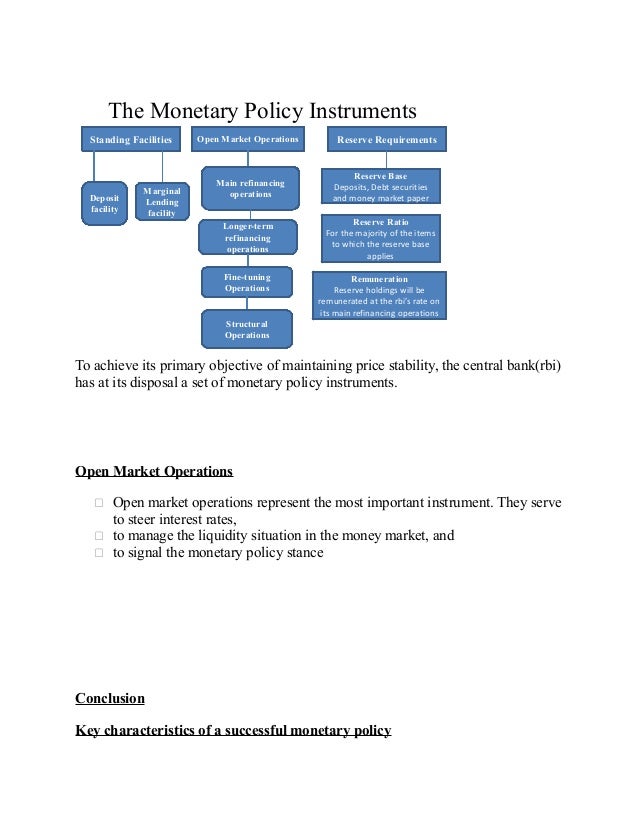

Open market operations. The Eurosystem’s regular open market operations consist of one-week liquidity-providing operations in euro (main refinancing operations, or. Longer-Term Refinancing Operations. Monthly. it launched a new phase of the Longer-Term Refinancing Operation (LTRO). Longer-Term Refinancing Operation. Longer-term refinancing operations are carried out through monthly standard tenders and normally have a maturity of three.

June 2. 00. 9 - The ECB announces its first 1. LTRO that closes with over 1,0. LTROs. December 2. The ECB announces its first LTRO with a three year term with a 1% interest rate and usage of the banks' portfolios as collateral. February 2. 01. 2 - The ECB holds a second 3. LTRO2, that provides 8.

Targeted Longer-Term Refinancing Operations (TLTROs) Targeted Longer-Term Refinancing Operations (TLTROs) TLTRO_reporting_template 1-6. ECB TLTRO 2.0 – Lending at negative rates. On Thursday, the ECB surprised observers by announcing a new series of four targeted longer-term refinancing operations. Pożyczki Pozabankowe, Kredyty Bez.

Since the programs, the bank has announced so- called Targeted Long- term Refinancing Operations - or LTLRO and LTLRO II - to further boost liquidity. These new operations are being conducted through at least March of 2. Alternatives to LTROs for Liquidity. Shorter- term repo liquidity measures provided by the ECB are called main refinancing operations (MROs). These operations are conducted in the same manner as LTROs, but have a maturity of one week. These operations are similar to those conducted by the U. S. Federal Reserve to offer temporary loans to U.

S. banks during hard times. Pozyczka Przez Internet Sms365 Szybka Las Vegas. Euro zone countries can also access liquidity through Emergency Liquidity Assistance (ELA) programs.

These "lender- of- last- resort" mechanisms are designed to be very temporary measures designed to help banks during times of crisis. Individual countries have the ability to run these operations with an ECB override option. Key LTRO Takeaway Points.

LTRO stands for "long- term refinancing operation" and is used to provide longer- term liquidity than standard MROs to banks during times of crisis. The ECB greatly expanded LTROs during the European sovereign debt crisis from a three- month maturity to a three- year maturity amid sharply higher demand. Other liquidity programs used by the ECB and independent governments include main refinancing operations (MROs) and Emergency Liquidity Assistance (ELAs).